What are the market mechanisms that contribute to price formation on these two markets ?

The compliant carbon market and the voluntary market

In the classical theory of price formation, these result directly from the confrontation of global supply and demand. Their confrontation must cause the price adjustments necessary to obtain an equilibrium.

But the existence of a market presupposes that two conditions are met: the goods or services in question must be fungible, that is to say things which can be replaced by things of the same nature, of the same quality and of the same amount ; the other condition is that there is a place of exchange.

The regulated carbon market fits these definitions and categories well.

– The quotas or authorizations to be emitted all have the same value: one ton of CO2 equivalent.

– Centralized platforms allow daily exchanges from all parts of the world

This is not the case with the voluntary carbon market: there is a lack of centralized exchange organizations and the carbon credits generated by reduction or absorption projects have the same value in terms of unit volume but differ about the accompanying sustainable development measures.

How to give a price to carbon on the voluntary market ?

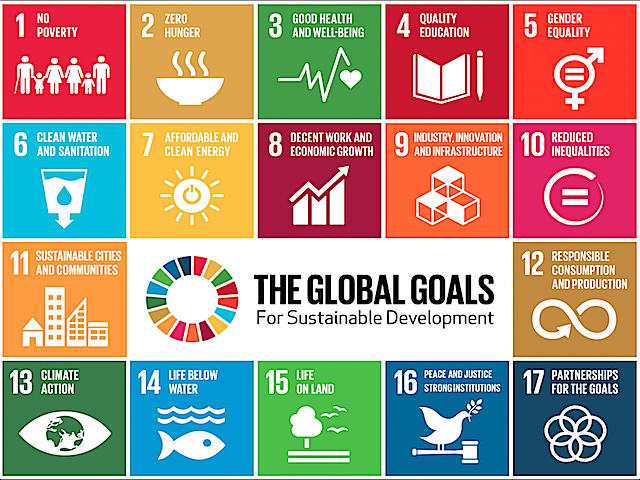

In fact, a carbon credit represents both a reduction or absorption of GHG but also the realization of various actions in favor of sustainable development: “beyond carbon” according to the accepted expression and which can be illustrated by the icons, created by the United Nations, and symbolizing goals or “Global Goals for Sustainable Development” (SDG).

As a result, each carbon project is profoundly different and difficult to assess on an objective basis. It is buyers’ preferences for these goals that influence the price.

The “Just price «

The fair price is a notion developed by Saint Thomas Aquinas which assigns a good a value based on fundamentals which must be distinguished from the market price which corresponds to the « current value » of this good. The fair price may correspond to the potential price estimated from elements considered objective (cost, utility, rarity, etc.); a substitute for the market price when there is no organized market providing a reliable reference; or finally, at the desirable price based on ethical assessments.

Gold Standard’s approach seems to be getting closer

One of the leading validating organizations, the NGO Gold Standard, asked the question of the « value » of a carbon credit. Why do carbon credits that represent the same volume of avoided GHGs have different prices? To answer it, Gold Standard analyzes three concepts:

1) The voluntary market cannot simply rely on the law of supply and demand.

Its goal is climate security and access to basic human rights such as food, water, education and good health. Failure to fully consider the real value they bring in terms of development benefits beyond carbon can accelerate a race to the bottom, meaning that the highest quality projects could be the first to fail.

2) A cost-based model takes into account the costs of implementing a project and should be used to help ensure the continued viability of projects.

To support this analysis Gold Standard uses the “Fair Trade” minimum price model. This calculates a minimum price that ensures average project costs will be covered, plus an additional “Fair Trade Premium” that goes directly to the local community to fund activities and help them adapt and become more resilient. to an already changing climate. The NGO thus establishes the minimum Fair Trade price for certain types of eligible projects (energy efficiency, renewable energy and afforestation/reforestation):

– Energy efficiency: €8.20 / tCO2e + €1 Fair Trade premium

– Renewable energy: €8.10 / tCO2e + €1 Fair Trade premium

– Forest management: €13 / tCO2e + €1 Fair Trade premium

3) Prices based on the delivered value.

Carbon projects go far beyond mitigating GHG emissions. Using a value-based model to price carbon credits must truly account for all of the environmental, social and economic impacts of a specific project, i.e. both in terms of reduced emissions and additional development benefits that can transform lives.

The EPA approach: the social and environmental cost

The US Environmental Protection Agency (EPA), for its part, published a report, updated in 2015, to estimate the total cost of carbon to society. It establishes that for every ton of carbon dioxide we emit into the atmosphere, we sacrifice between $11 and $212 in environmental degradation and negative social impacts.

Defining the right price for carbon credits is a complex task as the determinants are numerous and varied. However, the EPA’s assessment can help us define a « floor price ». The carbon credit buyer should know that below its lower threshold of $11, the price of carbon is not commensurate with environmental issues.