1.– Definition and complexity of the carbon market

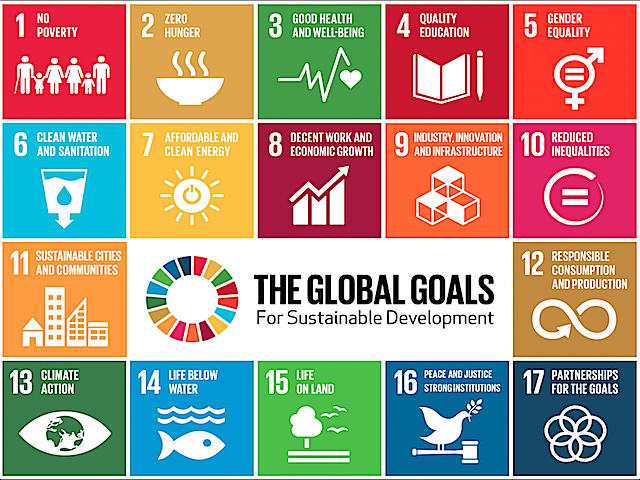

The expression “carbon market” owes its success to its apparent simplicity: the market where the rights to emit carbon dioxide are traded. But this simplicity is deceptive. The very idea of a carbon market is fundamentally complex and hides disparate realities and real semantic pitfalls. First of all, there is not one but two markets: the regulated market and the voluntary market which, however, communicate with each other up to a certain point. Then, who says “market” refers a priori to companies; However, the regulated market stems from commitments made by States but transferred to their companies, which involves multiple regulators who create rights trading systems that communicate imperfectly with each other. This multiplicity no doubt also explains why the legal nature of the rights to issue still poses a problem. Moreover, the carbon market does not only concern carbon dioxide but five other gases also endowed with a power of warming the atmosphere, a power calculated, it is true, in relation to the first, which serves as a benchmark for the market eponym. Finally, there is, for the general public, a somewhat « cognitive » difficulty which opposes the understanding of the very concept of the carbon market which is, in fact, based on a paradox. This market is commonly presented as a means to reduce GHG emissions. However, although emission rights are intended to regulate GHG emissions, they nevertheless appear, in the eyes of many, to be “rights to pollute”. It is all these difficulties of understanding and interpretation that this study must resolve.

2. – Plan

It is also the aforementioned difficulties that outline the plan of the present study. It is appropriate, first of all, to briefly outline the economic theory of trading in emission rights, which is essential for understanding the mechanisms of the carbon market. Secondly, with regard to the actual study of carbon market law, it seemed fundamental to reserve as much importance, if not more, for the creation of carbon market values as for their transactions. It is in the creation of values that lies the originality and the difficulty of analyzing the carbon market for the reasons that we have just explained and which are mainly due to the complexity and diversity of the role of regulators. Transactions, for their part, are similar to national or international sales of transferable securities even if they include particularities which will be developed later, in particular with regard to the registers materializing these securities and which are the essential instrument for their transfer. of property. We will devote part of this study to the voluntary market whose economic importance is, for the moment, much lower than the regulated market and whose main features can be defined in relation to the latter.